We see all of this in the news all the time with getting better with analytics and having more information as far as a “consumer rap sheet” on all of us; however the problem still lies in how this is used and the fact that when you dig deep there are tons of errors and flawed data to consider. You have to remember that even up to a few years ago we did not have the elaborate reporting system we have today and we have years and years of data input, which means years and years of mistakes and data input errors too, we are all human here last time I looked.

Again, Michael Moore did about the best absolute job with bringing this to light with the movie Sicko to where the woman was denied coverage on her claim when they found a “yeast infection” from many years ago that she did not disclose and the reality here is she probably forgot. This is the problem with how some in modern day technology are using data against people. It’s wide spread and this is large part of why the Occupy Wall Street movement is so big.

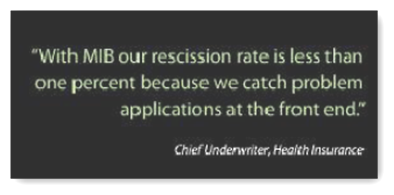

The MIB – Health Insurance Bureau Business Intelligence Mining May Go Beyond Just Healthcare Information

Now how far back are the searches for data going to go? The truth of the matter is that you may find a small percentage of folks out there without some kind of “flaw” whether it is correct or not correct lurking around and being connected to you. Bean counters see a flaw and and rather I should say the “algorithm” finds a flaw and moves your data file out of the “good” parameters set by those who write the queries, so now you are flawed by the data. So some may use no or a very small level of forgiveness here and this is where the madness begins. The MIB has been around long before computers too so that may give you some insight into how much information they might have and now of course, they market too.

The MIB – Health Insurance Bureau Business Intelligence Mining May Go Beyond Just Healthcare Information

Now, let’s add on identity theft, and there’s another new can of worms. People have nightmares over this and now you have to “prove” to a credit agency that a lot of what is tied to your records is not yours? Hey I’m a data base person who used to write code and this is the design here. Granted there will be some cases to where some real information is uncovered and some fraud may even be found, but for the most part when handed to “digital Illiterate cookie cutter” employees who are told to follow a certain procedure, well you know what happens and you are actually lucky if it gets to a human as the algorithm will be doing most of the work here.

This is not to discount the employees what so ever as they are hired to do a job and given instructions on how to do their job and many may not be allowed to go beyond what is shown on the screen and thus that is what they are instructed to use for customer services explanations and so forth and if they don’t follow procedures then might be out there with the Occupy movement too. Here’s a video below that explains how one woman just could not get the data fixed and you can see what her outcome was here, no insurance and this is still happening and I might say it’s getting worse.

Of course more data makes us smarter, that is if we know how to use it realistically and not rely totally on an algorithmic formula to do 100%. If you keep up with the news today there are tons of articles out there on “big data” and how to manage and use the rivers of data to make an intelligent decision by all means. Heck I think lawmakers should really get into this too so we have better thought out laws and get the folks out of the 70s and away from their “default” topic of abortions when they got lost in the tech world and needed laws. Now we have machine learning coming of age and just think if it is digging around through this old flawed data if it is in fact either fed in to the data bases or given access via the web? We might have “big flawed data” here with some type of precedence. Machine learning can be great and save tons of time and again emphasis on what is loaded and the parameters used for guidance with results returned.

WellPoint Hiring IBM Watson Technologies–Congress Needs to Wrap Their Heads Around Using Technology That Processes 200 Million Pages of Info in 3 Seconds to Make Laws

The problem is not the access of the data, but rather on how it is used. I have written a few times about FICO and what I feel to be their over extended marketing attempts here to sell mis matched analytics to insurers and big pharma. You can read more at the link and this was carried all the way over to the Daily Kos too a while back. Marketing today of analytics poses some real dangers when you take crunching numbers down to a personal analytics level with flawed data. Even Netflix say openly their algorithm and data is only 60% accurate, so when it makes a guess on what you might like, it’s the 60% percenter algorithm.

When creating risk assessments, we as consumers deserve better than 60% by all means especially if this means a decision on whether or not we get a claim paid or whether we would be underwritten.

FICO Analytics Press Release Marketing Credit Scoring Algorithms to Predict Medication Adherence–Update (Opinion)

Company Advertisements Get Caught Making False Claims And Are Called to Task And So Much of This Activity is in Healthcare

So with this new CoreScore program, what level of forgiveness will be programmed into this algorithm is my question? Is this yet one more wild good chase for the consumer to have to take their time to chase? We already have it in healthcare today and a recent report said doctors spend an average of 83k a year on red tape with insurers so that comes right out of their bottom line profits and who knows some may be higher than that as it would depend quite a bit on the demographics of their patients too, that’s common sense there.

So will we now be chasing this data to correct as companies present it to us? What if one has an issue back 20 years  ago, maybe something stupid one did as a kid? If it’s there, they will dig it up and will this be grounds for denying credit and again we have the big monster of identity theft. Will companies use this wisely or will the algorithm knock you out of the qualification parameters?

ago, maybe something stupid one did as a kid? If it’s there, they will dig it up and will this be grounds for denying credit and again we have the big monster of identity theft. Will companies use this wisely or will the algorithm knock you out of the qualification parameters?

Why Is Almost Everyone In Healthcare Marketing Their “Ass” Off

We have already very publicly been shown how governors, such as the one in Arizona had no clue on how to use analytics and could not find a little over a million in the budget for Medicaid transplants, digital illiterate officials elected who make life and death decisions? Ignorance killed in that example. This is why I made the post about the “Attack of the Killer Algorithms” as here they stand. By the way if you have not seen this one, worth a read with some great audio from NYU professor Siefe who wrote the book “Proofiness, the Dark Side of Mathematical Deception” and how it is used today, along with a great video from Kevin Slavin on how Algorithms impact our lives…again one not to miss.

“Numbers Don’t Lie, But People Do”–Radio Interview from Charles Siefe–Journalists Take Note, He Addresses How Marketing And Bogus Statistics Are Sources of Problems That Mislead the Public & Government

Occupying Wall Street–It’s All About the “Attack of the Killer Algorithms”–The Unfair and Marketing Exploit of Ethics Using Math–This Could be a Subject for Michael Moore to Explore and Document In a Movie

Self regulating agencies are also getting wise to this as you can see that FINRA and the SEC want some of this code to see how it was written and if it is fair. Just last week they found a Quant on Wall Street using flawed code. The quant knew for 3 years it was flawed and keep using it with clients…see what I mean, it’s all over the place.

FINRA and SEC Asking High Frequency Trading Firms To Hand Over the Algorithms of Their Trading Strategies And Code–Time for That Department of Algorithms?

Trading software is all about algorithms and who can create one that out performs the next one as far as the math and speed of the data. There has been no regulation in this area and back in August of 2009 when Madoff was all over the wires I suggested at that time that perhaps we needed a Department of Algorithms and here we are a couple years later, nothing done.

“Department of Algorithms – Do We Need One of These to Regulate Upcoming Laws?

This is “the insanity” and why the “Occupy” move lives as it should and there might be many out there that don’t even understand this behind the scenes data move themselves, but they can sure get a huge signal that something is not right and it doesn’t take a geek to see that when the Attack of the Killer Algorithms continues and denies, sending consumers on huge missions of finding all the errors and flaws that they had nothing to do with creating.

Don’t expect too much help either from some levels of Congress as it was noted that their levels of digital literacy still revolve around getting a pdf out in proper format…more on that below…as reported by Rachel Maddow on the GOP pledge.

The Properties of an Adobe pdf Document -Rachel Maddow Rips the GOP on Lack of General Consumer IT Knowledge And Exposes the Input and Authors of the Content–Lobbyists

Data analytics make us a lot smarter if used properly but they also create areas of abuse with over extending predictive numbers when they simply are wrong or flawed. Actually I made a post about a year ago that was very popular and it’s been around Forbes and other places about the up and coming next 12 step program, data abuse and addictions. Symptoms include lack of data integrity, flawed data and those who just can’t stop:)

Data Addiction and Abuse –The Up and Coming Next 12 Step Program Is On the Horizon–Side Effects Include Lack Of Data Quality, Integrity And Spasmodic Algorithms

Also, for the healthcare law interpretation, I also suggested that maybe the Supreme Court might get some help with sorting all their data, rent some space from the DOE as they have the 3rd fastest computer in the world that could do the job.

Supreme Court Likely to Rule on Healthcare Law Early Next Year–This Gives The Justices Time to Rent Some Computing Space from the DOE As They Will Need It

So how will they handle this new are of analytics? Will there be levels of forgiveness and will consumers have to chase down all this data too that they had nothing to do with it’s creation?

“In God we trust; all others must bring data”

This is what keeps the “Occupy Wall Street” movement active and alive with the challenges of doing the right thing and not using analytics as a source forget ethics and treating people as humans. Even our CTO goes about some of this in the wrong fashion too at times with his speeches in saying “ you can become a millionaire writing the right code”, but what is the right code and how is it applied to every day life and business?

I think we might all be looking to some major shake downs with checking the math used all over in the financial world and in healthcare.

Actually in healthcare, we are a step ahead here as medical records all have to be certified to function properly, an area to where insurers and the financial world could take some lesson in my small humble opinion, but we still deal with the insurers sending consumers on long data chases though, the other side with non certifiable algorithms. BD

Mortgage lenders will soon have access to new details about a prospective borrower's past -- such as past rental applications, inquiries to pay-day lenders, and missed child support payments -- that will be factored in to a new credit score.

Real estate and mortgage data aggregator CoreLogic says it's signed an agreement to work with Fair Isaac Corp., the owner of the widely used FICO score, to develop new credit risk scores for the U.S. mortgage industry.

Much of the data CoreLogic collects on consumers hasn't been available from traditional credit reporting agencies but is important to mortgage lenders, the company said.

CoreLogic says it will serve as a "supplemental credit repository," augmenting data provided by TransUnion, Equifax and Experian with property ownership and mortgage obligation records, property legal filings and tax payment status, rental applications and evictions, inquiries and charge-offs from pay-day and online lenders, and consumer-specific bankruptcies, liens, judgments and child support obligations. The Santa Ana, Calif.,-based company will generate a CoreScore Credit Report for lenders to alert them to bad debts that might previously have gone undiscovered. The reports may also help some consumers by identifying previously hidden credit history that reflects well on them, the company said.

"By blending the unique data from CoreLogic with the analytic expertise of FICO, we will be able to deliver a new and more predictive credit score with our recently launched CoreScore Credit Report," said Tim Grace, senior vice president of Product Management and Analytics for CoreLogic, in a statement. "Together, this new credit report and credit score will provide the mortgage industry with increased visibility into consumer credit behavior and improved credit risk analysis."

http://realestate.aol.com/blog/2011/10/21/new-credit-score-will-tell-lenders-more-about-you/

Mortgage lenders will soon have access to new details about a prospective borrower's past -- such as past rental applications, inquiries to pay-day lenders, and missed child support payments -- that will be factored in to a new credit score.Level ii Quotes

ReplyDelete